Table of Contents

Learn to fill Tax Information in Google AdSense I Complete Step by step guide information

Are you using Google Adsense to earn revenue, either you are having a YouTube channel, you need to submit your tax information to Google Adsense on or before 31st of May 2021?

However, if you have a blog or app on the Google play store, you can also submit your tax information on Google Adsense.

YouTube is set to start deducting taxes from the creators who lived outside the USA. If you are having a YouTube channel, and are from outside USA. Then, you have to pay taxes on the earnings that you generate from viewers in the USA.

This new policy will be in effect from the 01st of June 2021, so every creator has to submit their tax information in Google Adsense on or before the 31st of May 2021, which determines the correct amount of taxes to deduct.

These changes will affect to every YouTube creator who lived outside the USA, including that one in India. Though, for your reference, there won’t be any similar tax deduction for the creators who lived in the USA.

What is YouTube earning?

YouTube earnings cover all the earnings you generate from ad views, YouTube Premium, Super Chat, Super Stickers, and Channel Memberships.

How much tax will be deducted from June 2021?

There will be three scenarios in which a deduction will be made from your Google Adsense account if you are living outside the USA. You have to submit tax information in your Google Adsense account on or before the 31st of May 2021, failing which you will be charged tax on your total revenue earned from Google Adsense.

- If you provide your tax information to Google Adsense on or before the 31st of May 2021, you will be charged 15% of the total revenue that you generate from the viewers of the USA. For example, if you generate 1000$ in revenue in a month, out of which 100$ is from the USA, then you will be charged 15$ against Tax. (USD 100*15%) (This percentage is for creators who lived in India, please note tax percentage will be different depending on whether the country of the creator has a tax treaty relationship with the USA)

- If you don’t submit your tax information, you will be charged 24% as tax on your overall revenue in a month. For example, if you generate 1000$ revenue in a month, you will be charged 240$ against tax (USD 1000*24%)

- If you submit tax information but mention your PAN details, then you will be charged 30% tax instead of 15%.

So, make sure you submit your tax information timely and mention your PAN details while submitting the form on Google Adsense.

How to update your US tax information?

All YouTube creators who monetize their channel need to submit their tax information on Google AdSense on or before 31st of May 2021.

Below is a step-by-step process that every YouTube creators need to follow:

STEP 1: Sign in to your Google AdSense account >

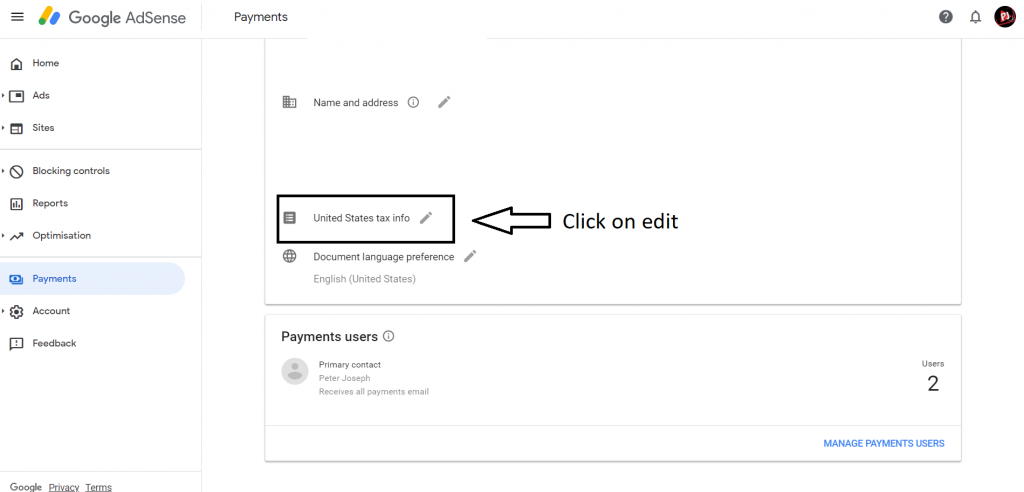

STEP 2: Click on Payments >

STEP 3: Click on manage settings >

Scroll to the payments profile, and click edit next to United States tax info.

Click “Manage Tax Info”.

So, to get payouts from Google, make sure that you provide your tax information.

Creators may need to re-submit taxation information every three years. Click “ADD TAX INFO”, and proceed.

STEP 4: To continue, Google will verify that it’s you. A new window will appear to sign in. You may need to turn off any pop-up blockers to see the sign-in screen, as shown below:

Enter your password and Click “NEXT” to continue.

STEP 5: Below page will appear, wherein you need to select whether your account is individual or nonindividual/entity. Select any one of them, and then select No, since you are not a citizen of the United States. Then click NEXT to continue,

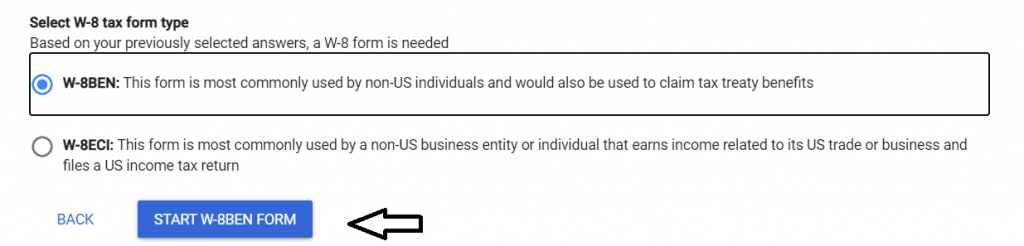

STEP 6: Now, as per the below image shown, you need to Select W-8 tax from the type, wherein you have to select the first one, i.e. “W-8BEN: This Form is most commonly used by non-US individuals and would also be used to claim tax treaty benefits.”

After selecting the same, click “START W-8BEN FORM” to proceed.

STEP 7: Enter your name (Please make sure that your name exactly matches with as shown on your tax documents, i.e. Your PAN Card). After entering your name, select the country of citizenship.

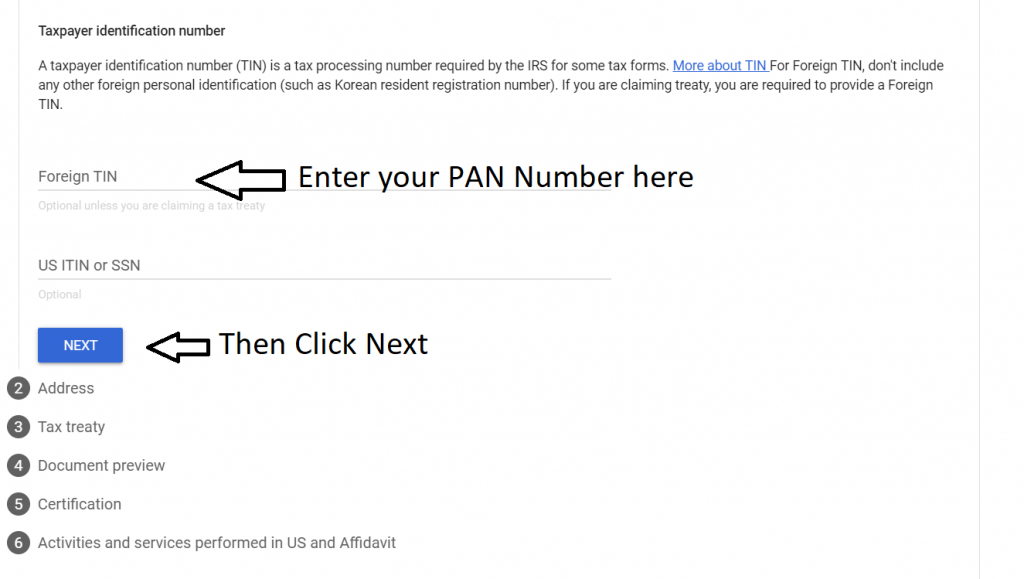

STEP 8: As shown in the below image, you will see “Foreign TIN”, where you have to enter your PAN Number, and then click “NEXT”

STEP 9: Enter your complete postal address carefully, and tick the option “Postal address is same as permanent residence address”, or else enter your mailing address which is different from the permanent residence address.

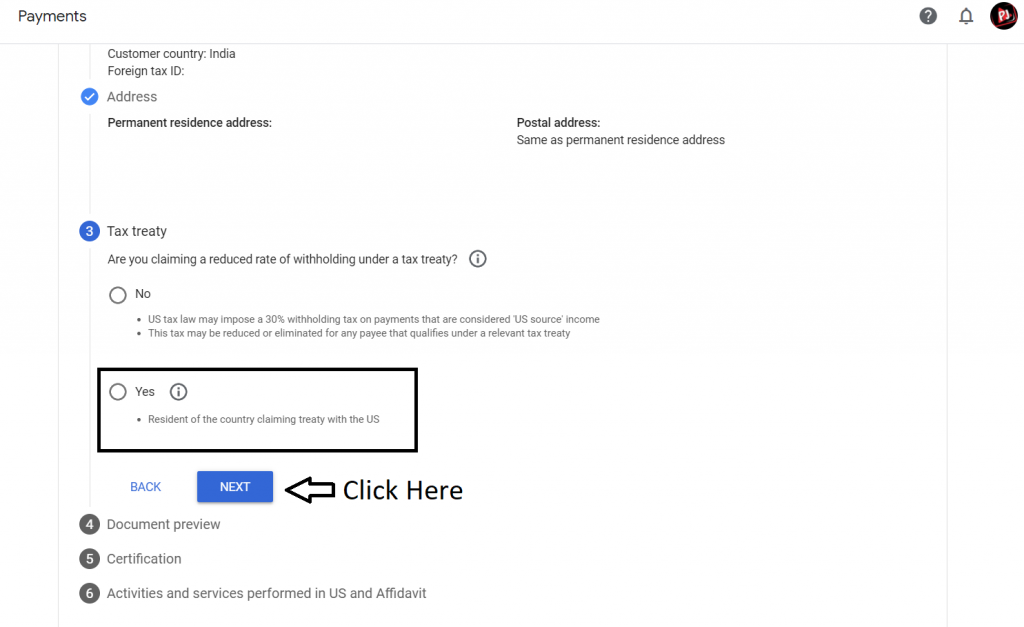

STEP 10: Since, we are claiming a reduced rate of withholding under a tax treaty, therefore select “YES” and click “NEXT” to proceed further.

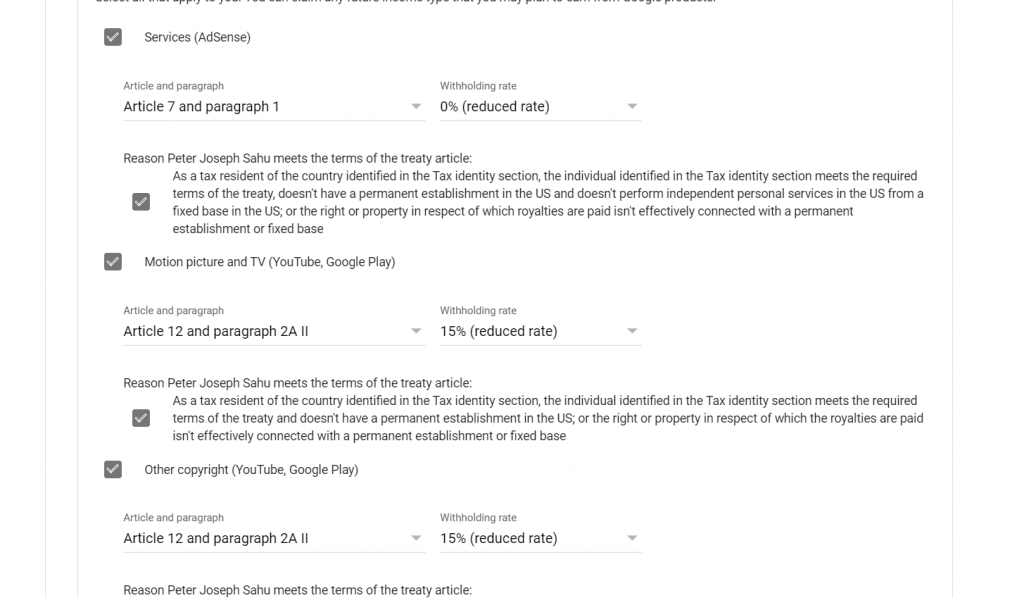

STEP 11: Fill in the details as per shown in the below image, and proceed further accordingly.

STEP 12: Now, to sign the form, enter your legal name (Write your full legal name), and select the first option, as shown in the below image. Click “NEXT” to proceed further.

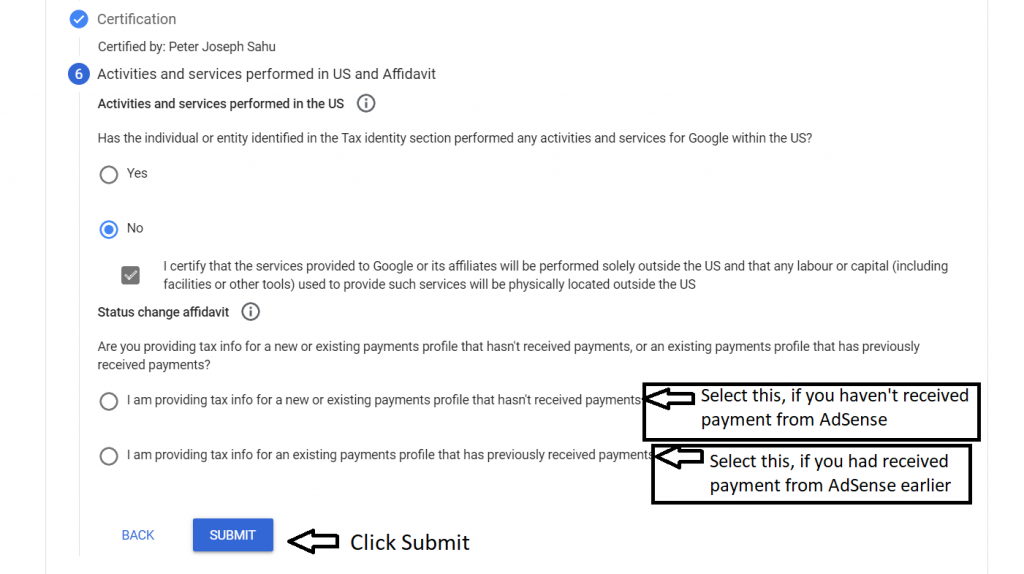

STEP 13: Now, before submitting the form, you must select “NO” under activities and services performed in the US, and agree with the terms by ticking the box.

In the status change affidavit, if you are new and haven’t received any payment from AdSense, select the first option, whereas

If you are an existing payments profile that has previously received payments, then select the second option. Then click on “SUBMIT”.

Leave a Reply